Odoo Accounting

Closing work onOdoo

Odoo's goal is to enable you to monitor your activity closely and in real time, and to make your closing operations as simple as possible, while respecting the logic of accounting principles.

The basics

In Odoo, you don't need to enter a transaction to close the income statement. Reports are calculated automatically.

For balance sheet accounts, the initial balance corresponds to the sum of all transactions recorded in previous years, since there is no retained earnings (closing balance sheet before distribution).

The income statement corresponds directly to the dates of your report.

The account balance only includes transactions carried out during the year, and the initial balance is always zero.

Match your bank balance with your book balance

Reconcile your bank balance with your bank statement, justify any suspense items and amend your bank reconciliation statement if necessary.

Ensure correct accounting and completeness of customer and supplier invoices

Verify lettering and reconciliation of all supplier and customer payments

Ensure that automatically entered depreciation entries are correctly recorded in the accounts

When scaling VAT, you can consult the tax report generated with a single click. (VAT breakdown based on taxable sales and deductions).

Make accounting adjustments (invoices not received, prepaid expenses, etc.).

If this feature is not activated, you can still calculate the difference using the stock valuation report.

Closing the financial year

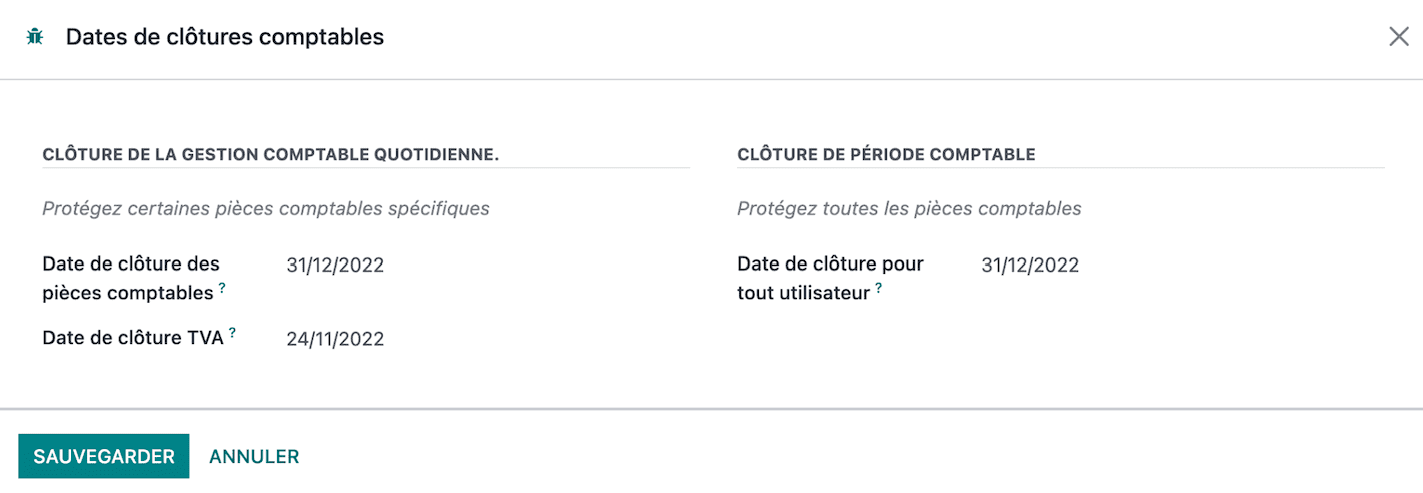

When closing, we offer you a feature that will prevent you from making irreversible errors: the ability to block the entry of any new operations.

This means you can lock in the financial year once you've completed your auditing work. Speaking of auditing work, Odoo lets you view and group accounting entries in the form of analysis tables, and reclassify directly from financial reports.

Retained earnings

As far as retained earnings are concerned, Odoo follows a new logic that is even simpler than generating entries in carry-forward accounts, which is becoming obsolete.

Today, Odoo automates the allocation of profits (after-tax earnings) to deferral accounts (set up in advance).

Profit appropriation is carried out when the trial balance is issued, specifying the start and end dates of the accounting period.

Designed by Karizma, field-proven, ready to boost your performance

From business modules already integrated at our customers customers

In addition to Odoo's standard modules, our customers integrate specific business modules developed by Karizma, based on our dual technical and sectoral expertise.

Industry, services, construction, distribution... each sector has its own particularities. Our solutions meet specific needs: business management, advanced planning, quality, subcontracting, fleet management, MES, and many others.

These plug & play modules enable faster deployment and better adaptation to challenges in the field.

Let's talk about your project!

Do you have a project or questions? Our team is here to support you in your digital transformation. Don't hesitate to contact us to discuss your needs.

Contact details :

Email: contact@karizma.ma

Phone: +212 522 103-925